Maximize the Value Received Selling your Minerals

The EnergyNet Minerals platform attains the highest value for your oil and gas minerals and royalty sales because we make buyers compete. There are thousands of companies that would like to buy your oil and gas minerals and royalties. How do you know if you are getting the best value from a single offer?

View Active Minerals Listings

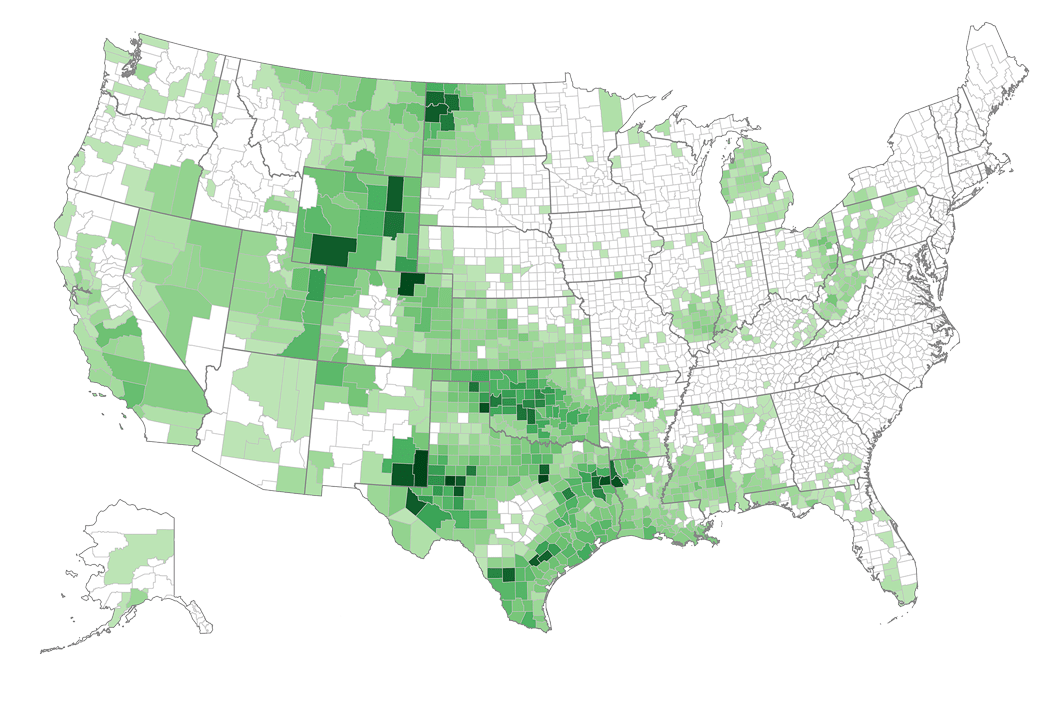

The EnergyNet platform matches buyers and sellers together for oil and gas minerals and royalties. Sellers of oil and gas properties receive full value by fully exposing their opportunity to over 48,000+ financially qualified buyers and making those buyers compete to own the assets. Financially qualified buyers acquire minerals and royalties via EnergyNet because there is a wide variety and steady stream of opportunities to choose from. Buyers enjoy the fact that all the information needed to evaluate an opportunity and conduct an evaluation is at their fingertips.